Investing in real estate offers a range of benefits that can significantly impact your financial future. Whether you’re a seasoned investor or new to the game, understanding the benefits of real estate investment is crucial for making informed decisions. This guide delves into the benefits of investment in real estate, providing insights into why real estate can be a lucrative addition to your investment portfolio.

Content

1. Financial Security and Steady Income

One of the primary advantages of real estate investing is the potential for financial security through a steady income stream. Stable cash flow from rental properties can provide a consistent source of income, making real estate a reliable option for those seeking passive income. Unlike other investments that may fluctuate, rental income from real estate typically remains stable, especially in high-demand areas.

Passive income streams are another key benefit. With real estate, you can earn money without needing to actively manage the property daily. Property management companies can handle the day-to-day operations, allowing you to enjoy the benefits of rental income with minimal involvement.

Furthermore, diversification of income is a significant advantage. By investing in real estate, you add another layer to your overall investment strategy. This diversification helps reduce the risk associated with relying solely on stocks, bonds, or other investment vehicles.

2. Long-Term Appreciation

Long-term benefits of property investment include the potential for property value to increase over time. Real estate is known for its ability to appreciate in value, especially in growing markets. Historical data shows that real estate often outperforms other asset classes over the long term, making it a solid choice for investors looking to build wealth.

Market trends play a crucial role in property appreciation. Factors such as location, economic development, and infrastructure improvements can drive property values higher. By staying informed about these trends, investors can make strategic decisions to maximize their real estate investment returns.

The investment horizon is also essential. Real estate investment typically requires a long-term commitment. Patience and a long-term perspective can lead to substantial gains, as property values tend to increase steadily over time.

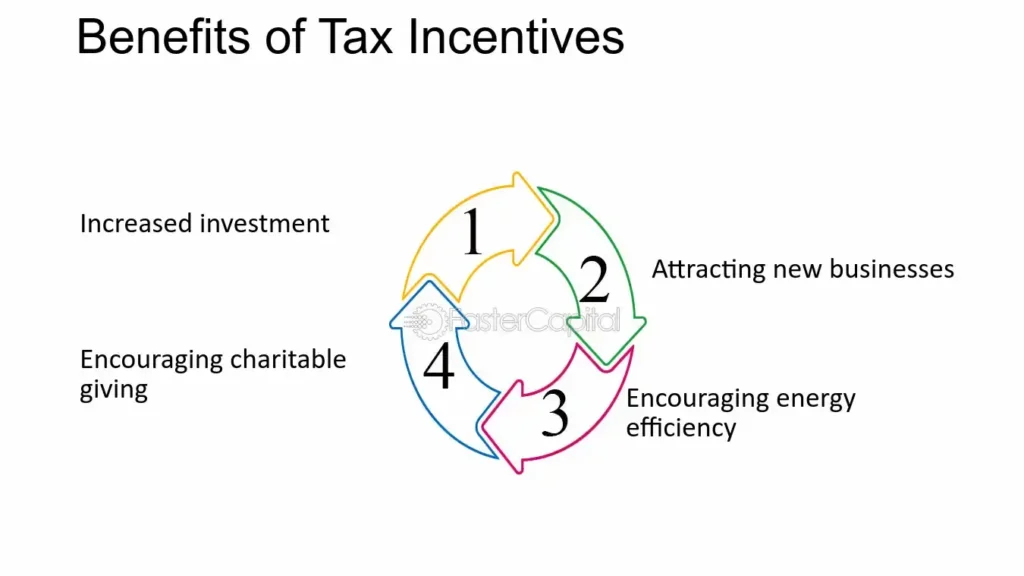

3. Tax Benefits and Incentives

One of the standout advantages of real estate investing is the array of tax benefits available to property owners. Real estate investors can deduct various expenses, including mortgage interest, property taxes, and repair costs, which can significantly reduce taxable income.

Depreciation is another valuable tax benefit. By depreciating the value of the property over time, investors can offset rental income with depreciation deductions, reducing their overall tax liability.

Additionally, there are various tax incentives provided by the government for real estate investors. Programs such as opportunity zones and energy-efficient property incentives offer financial benefits and can enhance the overall returns on real estate investments.

4. Leverage and Financial Growth

Using leverage is a powerful strategy in real estate investing. By borrowing funds to purchase property, investors can amplify their returns. This means that you can acquire more property or a higher-value property with less of your own money, potentially leading to greater real estate investment gains.

The concept of return on investment (ROI) in real estate involves maximizing gains through strategic leverage. By carefully managing borrowed funds and focusing on high-return properties, investors can achieve impressive financial growth.

However, risk management is crucial when using leverage. While leveraging can enhance returns, it also increases risk. Investors should balance their use of leverage with a solid risk management strategy to protect their investments and ensure sustainable growth.

5. Portfolio Diversification

Adding real estate to your investment portfolio offers portfolio diversification. Diversifying across different asset classes helps spread risk and can lead to more stable overall returns. Real estate often behaves differently from stocks and bonds, providing a hedge against market volatility.

Asset class benefits are another reason to consider real estate investment. Unlike stocks and bonds, real estate provides a tangible asset that can offer both income and appreciation. This combination of features makes real estate a unique and valuable addition to any investment strategy.

Moreover, long-term stability is a significant benefit of real estate. Real estate typically exhibits lower volatility compared to other investments, making it a stable choice for investors seeking to balance their portfolios and achieve consistent returns.

6. Tangible Asset Ownership

Owning physical property offers several advantages over intangible investments. Real estate is a tangible asset that you can see, touch, and manage. This physical presence can provide a sense of security and control that other investments lack.

Control over investment is another key benefit. As a real estate investor, you have direct management and decision-making authority over your property. This control allows you to make improvements, manage tenants, and optimize the property’s performance according to your goals.

Additionally, real estate offers the potential for personal use. Depending on the property, you might have the opportunity to use it for personal purposes, such as vacation homes or rental properties for personal enjoyment.

7. Wealth Building and Legacy

Investing in real estate is a powerful way to build generational wealth. By acquiring and holding properties over time, you can create a lasting legacy for your heirs. Real estate can be passed down through generations, providing long-term financial benefits for your family.

Building equity is another advantage of real estate investment. As you pay down your mortgage and property values increase, you build equity in your property. This equity can be leveraged for future investments or used to secure loans, further enhancing your financial position.

Legacy planning is an essential aspect of real estate investment. Including real estate in your estate plan can help ensure that your wealth is preserved and transferred according to your wishes, providing financial security for your loved ones.

Conclusion

In summary, the benefits of investment in real estate are numerous and varied. From providing financial security and steady income to offering tax benefits and long-term appreciation, real estate investment can be a valuable addition to your financial strategy. By understanding the advantages of real estate investing, including real estate investment returns, long-term benefits of property investment, and the reasons why invest in real estate, you can make informed decisions and achieve significant financial gains.

Embracing real estate as part of your investment portfolio can lead to lasting benefits and contribute to your overall wealth-building strategy. As with any investment, it’s essential to stay informed, manage risks, and approach real estate with a strategic mindset. With the right approach, real estate can be a powerful tool for achieving financial success and building a secure future.

Elena Mohr is a dedicated home blogger who has been blogging for over six years. She covers everything home related. Elena also loves writing posts about her travels to Europe with her husband and two children.